Market cap of all cryptocurrencies

“Bitcoin’s difficulty has increased significantly, making solo mining nearly impossible without a massive investment,” said crypto expert and lawyer John Deaton roulette free games for fun. “Cryptocurrency mining has the potential to be rewarding, but it is not a get-rich-quick scheme. Long gone are the days when an individual could mine Bitcoin on a laptop.”

Bitcoin Cash was created as a result of a hard fork from Bitcoin in 2017. It was designed to address Bitcoin’s scalability issues by increasing the block size limit. Bitcoin Cash also uses the SHA-256 algorithm, and mining it is similar to Bitcoin mining.

Blockchains are a series of transactions grouped in blocks, with each added to the end of all blocks before it. Once a block is added to the end of other blocks, it cannot be reversed, and the transactions within it are finalized. Miners compete with their peers for the right to validate transactions and add a new block.

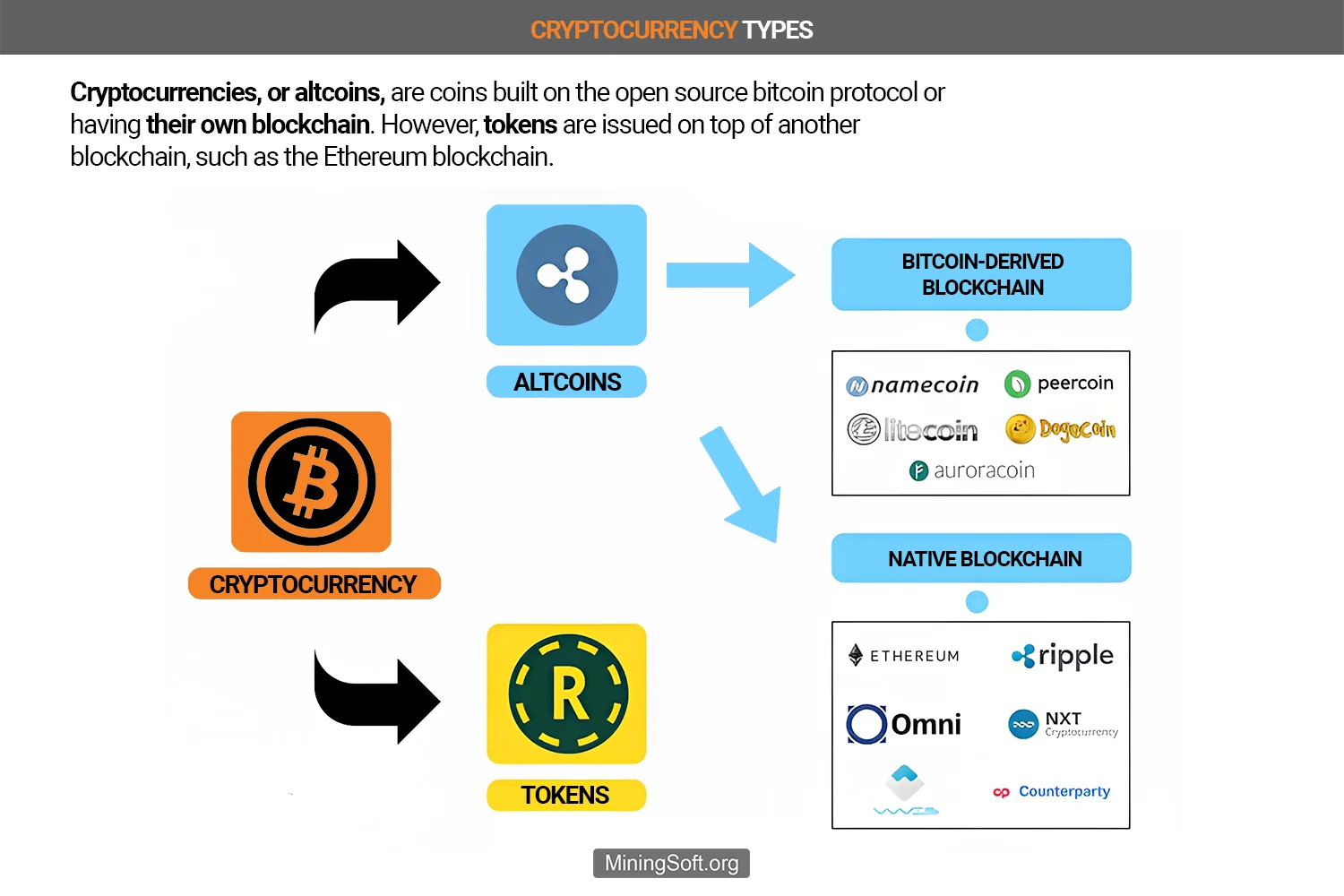

Are all cryptocurrencies the same

The fiat-crypto rates are changing and we can’t expect that they will stay the same all the time, because the crypto market has a different dynamic than the global financial system. For example, Bitcoin is now going close to $13,000 per one coin, but one Litecoin is equal to $56, and one Ether is $412. There is some crypto money that is related to the traditional currencies too. This is another one thing that shows us how different are these currencies, but also, that we can’t expect the situation will be the same forever. Maybe one day some of the smaller currencies will have a chance to be huge as the Bitcoins.

Much of this may not mean anything to you if you only have a cursory knowledge of how cryptocurrencies work. Suffice it to say that not every project marketed as a cryptocurrency project meets all six of the criteria. Libra is a good example.

The lack of decentralization in digital currencies creates issues with their transparency. The major difference between digital currency and cryptocurrency suggests that the details of digital currencies are under the control of the service providers, senders, receivers, and banking authorities. Therefore, conflicts in the domain of digital currencies require the intervention of law and bureaucracy.

The fiat-crypto rates are changing and we can’t expect that they will stay the same all the time, because the crypto market has a different dynamic than the global financial system. For example, Bitcoin is now going close to $13,000 per one coin, but one Litecoin is equal to $56, and one Ether is $412. There is some crypto money that is related to the traditional currencies too. This is another one thing that shows us how different are these currencies, but also, that we can’t expect the situation will be the same forever. Maybe one day some of the smaller currencies will have a chance to be huge as the Bitcoins.

Much of this may not mean anything to you if you only have a cursory knowledge of how cryptocurrencies work. Suffice it to say that not every project marketed as a cryptocurrency project meets all six of the criteria. Libra is a good example.

Do all cryptocurrencies use blockchain

In the cryptocurrency hall of fame, Bitcoin and Ethereum steal the spotlight. Bitcoin aims to replace traditional payment methods, while Ethereum is known for its smart contracts and Ether token. These are not just cryptocurrencies; they're trailblazers in the crypto vs blockchain landscape.

Blockchain is the technology that enables the existence of cryptocurrency (among other things). Bitcoin is the name of the best-known cryptocurrency, the one for which blockchain technology, as we currently know it, was created.

The Solana (SOL) blockchain has been around since 2017, and is one of the fastest chains, with a transaction speed of 3,000 TPS (theoretically, up to 710,000). The highly scalable Solana blockchain achieves this impressive speed using a hybrid proof-of-history (PoH)/proof-of-stake (PoS) consensus mechanism.